Saturday, December 10

A Midwinter Day’s Meetup

Discussion Topics:

- Invest Like a High Net Worth Investor

- My Spending Plan Sucks! ~ Grappling with Inflation in Uncertain Times

- A Million is Not Enough or: How I Learned to Stop Worrying and Love the 2% Rule

Links:

- The 2% Rule for Retirement Spending – Rational Reminder 229

- The Safe Withdrawal Rate research paper

Saturday, November 5, 2022

Topic: Healthcare–Private insurance, ACA, HSA’s, Medicare

|

|

|

The Healthcare Maze by Jeanne Texeira

Saturday, October 8, 2022

Saturday, September 17, 2022

Our first in-person meeting since March 2020.

Saturday, August 13, 2022

Topic: Double Header: The Boglehead Traveler and Is Crypto the New Tulipmania?

The Boglehead Traveler: Led by Greg Dietrich

When Greg isn’t cooking up ideas for meetings, you’ll find him walking on the bike trail close to his house or planning his next vacation adventure.

What travel tips have worked for you? We’ll pool our suggestions for saving money on airline tickets, accommodations, meals and experiences, international travel, eco-tourism, cruises, guided tours vs. doing it yourself, how to plan trips, maintain a budget and maximize enjoyment while being frugal, when to splurge, getting the most from your money.

Saturday, July 16, 2022

Christine Benz, Morningstar

Saturday, June 11, 2022

Saturday, May 14, 2022

Saturday, April 9, 2022

Saturday, March 12, 2022

|

|

Jerome spent his career working in Telecommunications in various engineering, product management and strategy & planning positions. He’s now financially independent and volunteers part of his time on personal finance and passive investing topics. He’s an active member of the Bogleheads community, maintaining various historical databases, occasionally writing blog articles. He acted as the coordinator of the Metro-Boston Bogleheads chapter for 6 years. When not playing with spreadsheets, Jerome likes to fish, travel and read.

Saturday, February 12, 2022

Saturday, January 8, 2022

Saturday, December 11, 2021

|

Chris Goslow is a composer, pianist, and piano teacher. He and his wife have lived happily in Sacramento since 2012. Chris is an advocate for index fund investing and financial literacy. He is also a dedicated runner who completed two marathons in 2021–the California International Marathon and a solo marathon along the American River.

The presentation is here.

Saturday, November 13, 2021

|

|

The interview video is here.

Saturday, October 9, 2021

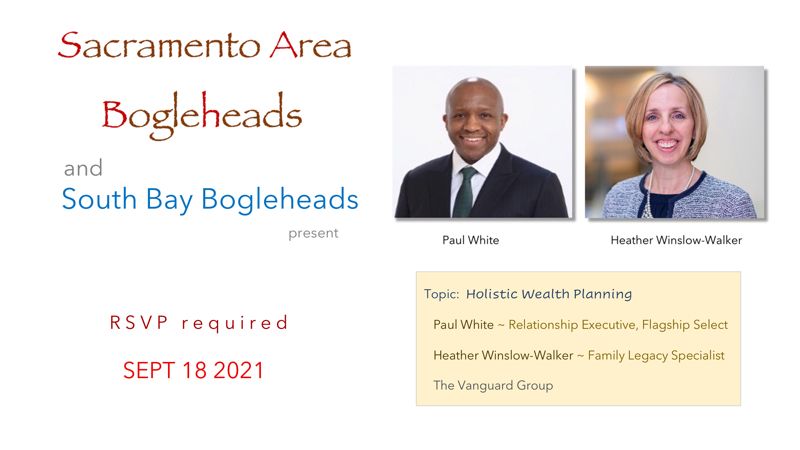

Saturday, September 18, 2021

Saturday, August 14, 2021

Topic: Socially Responsible Investing: Environmental, Social, Governance (ESG)

Kevin Dillon provided us with a deep dive into ESG investing—its history, current popularity and probable future. Kevin’s been an investor for 5 years and is a voracious reader of financial books and investing websites. He has been a member of Sacramento Area Bogleheads since 2017 and has never missed a meeting! He currently serves on the SABH chapter leadership team. In 2020 Kevin spoke about alternative investments for both the Sacramento and South Bay Bogleheads chapters.

The presentation slides are here. The presentation video is here.

Saturday, July 10, 2021

Topic: Lifestyles of the Rich and Frugal: A guided discussion on ways to build and preserve wealth.

We discussed the myriad ways to build and preserve wealth by living beneath ones means. All about spending less, lifestyle, how the average investor can live well without going into debt, the rewards of delayed gratification, ideas on how to implement a budget or mindset, when to increase spending. Asset allocations likely to result in sustained financial success in accumulation, early and late retirement phases.

Facilitator: Greg Dietrich. Greg has been an investor for nearly 20 years, gainfully unemployed for the last 5 of those years! He learned along the way that nurturing a portfolio of different investments combined with paying off debt (and more than a little luck) could lead to financial independence. When he’s not cooking up ideas for meetings, you’ll find him walking on the bike trail close to his house or planning his next vacation adventure.

Saturday, June 12, 2021

Facilitator: Greg Dietrich

Greg’s been an investor for nearly 20 years and unemployed for 5 of those years. More importantly, he learned along the way that nurturing a portfolio of different investments combined with paying off debt (and a bit of luck) could lead to financial independence. When he’s not cooking up ideas for meetings, you’ll find him walking on the bike trail close to his home or planning his next vacation adventure.

Sunday May 16, 2021

Topic: To Every Season

A Review of Estate Planning for Each Season of Life

Speaker: Nancy Williamson Esq. Her profile is here. Her presentation is here.

Saturday April 10, 2021

Beyond CDs and Bonds: Fixed Income Alternatives in the Low-Yield Environment

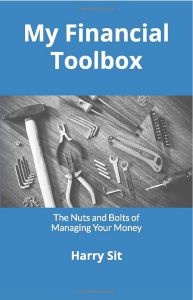

Speaker: Harry Sit

|

|

Saturday March 13, 2021

How Diversification Works

Speaker: Greg Dietrich

|

|

Greg’s presentation is here. The presentation video is here.

Other resources related to diversification:

Diversification (finance): https://en.wikipedia.org/wiki/Diversification_(finance)

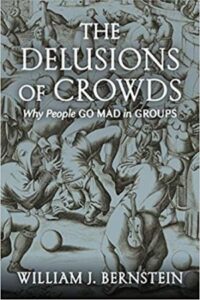

The Intelligent Asset Allocator by William Bernstein, McGraw Hill 2001, 2017

5 Tips for Diversifying Your Portfolio: https://www.investopedia.com/articles/03/072303.asp

Vanguard’s Principles for Investing Success (2020): https://about.vanguard.com/what-sets-vanguard-apart/principles-for-investing-success/ISGPRINC_062020_Online.pdf

3 Ways Diversification Saved Us During the CoronaBear by Jim Dahle: https://www.whitecoatinvestor.com/diversification-saved-us-coronabear/

How Investment Diversification Works: https://money.howstuffworks.com/personal-finance/financial-planning/diversification.htm

How Diversification Works [Rebalancing] by Ben Carlson – A Wealth of Common Sense: https://awealthofcommonsense.com/2014/07/diversification-works-2/

How Does Diversification Actually Work? by Bob French, CFA: https://retirementresearcher.com/diversification-actually-work/

Saturday February 20, 2021

Winners and Losers–2020 in the Rear View Mirror

Speaker: Greg Dietrich

Greg’s presentation is here

Recommended Article: How to Calculate your Return- The Excel XIRR Function

Saturday January 9, 2021

A Conversation with J.L. Collins

Author of The Simple Path to Wealth

Saturday December 12, 2020

Cybersecurity: Protecting Your Digital Assets

Speaker: Alan Baker

Alan’s presentation is here.

An interview with Alan on Gnat-TV

Saturday November21, 2020

International Investing – Why it Matters

Speaker: Paul White, CFP, Relationship Executive, Flagship Select, The Vanguard Group

Paul’s presentation is here.

Saturday October 10, 2020

Uncommon Common Sense: Investing in Index Funds

Speaker Greg Dietrich’s presentation in PDF format – 33 pages/slides

Saturday September 12, 2020

Do annuities make sense for your portfolio?

This was a joint Zoom meeting of the Sacramento and South Bay Bogleheads chapters.

Speaker Mel Turner’s slides in PDF format

Annuity Riders | 11 Most Common Annuity Riders to Fit YOUR Needs, by Jeff Rose, Good Financial Cents, 2020

July 11, 2020: Social Security & Retirement Q&A

Mike Piper, CPA is the author of several books including Investing Made Simple. He runs the popular Oblivious Investor website and the Open Social Security calculator.

June 16, 2020: The Bogleheads Happy Hour

References:

Investing through Volatile Times (Part 2)

By Chris Goslow June 8, 2020

Rational Reminder Episode 100: Prof. Kenneth French: Expect the Unexpected by Ben Felix May 28, 2020

June 6, 2020: The Good, The Flawed, the Bad, and The Ugly

The World of Alternative Investments According to Larry Swedroe

Presentation Slides are here.

May 9, 2020: A Practical Guide to Staying Afloat

Presentation Slides are here.

Referenced Articles:

April 11, 2020: Finding the Bottom: Choices During a Bear Market

Presentation Slides

Finding the bottom-Presentation.pdf

https://drive.google.com/file/d/17aVbDC0byLx_cchqI_bov9XR8EVLDIC9/view?usp=drivesdk

Referenced Articles:

From Harry Sit (aka The Finance Buff):

Tax Loss Harvesting vs Rebalancing vs Doing Nothing (2015)

https://thefinancebuff.com/tax-loss-harvesting-vs-rebalancing.html

Rebalancing in a Bear Market (2009)

https://thefinancebuff.com/rebalancing-in-a-bear-market.html

From Bogleheads:

Opportunistic Rebalancing: A New Paradigm

https://www.bogleheads.org/forum/viewtopic.php?t=10670

From Christine Benz: 10 Sources of Emergency Cash, Ranked from Best to Worst. Morningstar Mar 30, 2020

https://www.morningstar.com/articles/975122/10-sources-of-emergency-cash-ranked-from-best-to-worst

From Ben Carlson: My New Theory About Future Stock Market Returns, A Wealth of Common Sense

https://awealthofcommonsense.com/2020/04/my-new-theory-about-future-stock-market-returns/